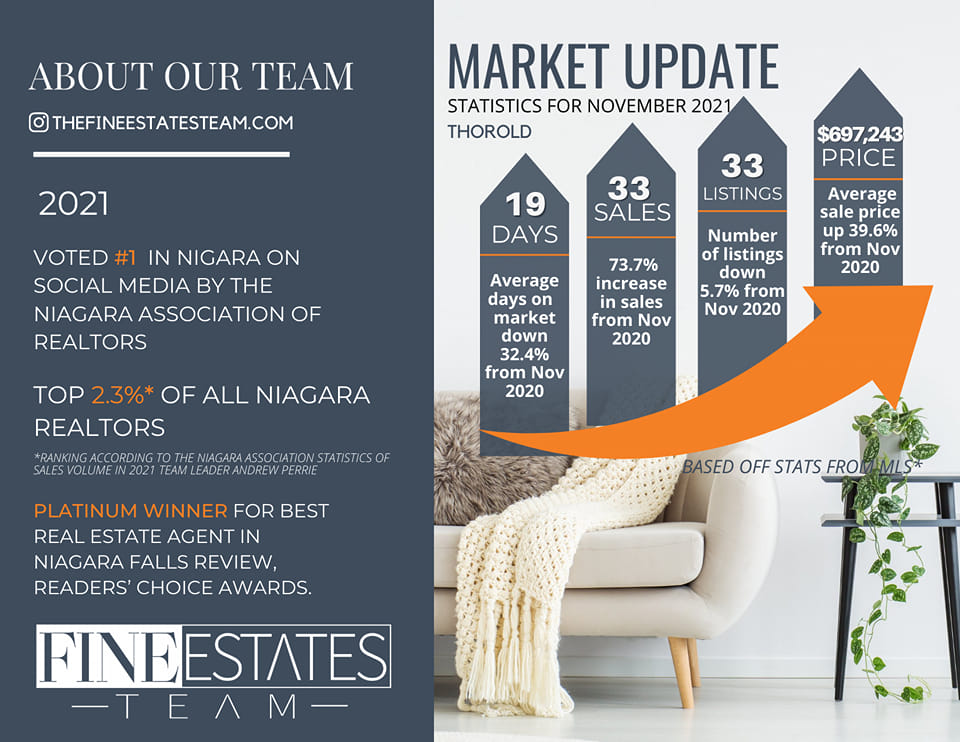

Real estate news showed us the cost to purchase a Thorold home reached $697,243 in November 2021. Yes, the real estate reports indicated the Home Price Index presents an increase of almost 40 percent from the HPI in November 2020, according to statistics from the Niagara Association of Realtors, MLS. The reality across the country is that prices are going up for housing, food, and other major purchases.

With the average Canadian home costing nearly $1 million dollars in many cities across the country, buying a house is one of the biggest purchases you’ll ever make.

This Thorold real estate news is a stark reality for many families in our community.

Just check out some of the comments on this topic shown on the Shop Thorold Facebook page. Go to the post and you will also find more statistics reported by Realtor – Partner at Fine Estates Team at Revel Realty, Crystal Simons.

Community Comments on Thorold Home Prices

It’s sad that Thorold people are leaving because they can’t afford to live here any more.

Cheryl Lee Wyllie

Katherine Power

It’s not just happening in Thorold – most homes in Niagara are now selling for more than the locals can afford on their salaries.

If you are just selling great? But if your selling and then buying don’t think it’s worth it?

Stephen Zeliznak

Young people are moving out east. This is going to be known as Toronto South because young adults from this area can’t afford a house here.

Karen McNulty

Consider All Expenses in Thorold Home Ownership

Before making an offer to buy a house in Thorold, keep in mind that the cost of home ownership doesn’t stop when you unlock the front door.

Consider the regular maintenance, utilities, and insurance, emergency repairs, and other expenses make it important for families in Thorold to account for all the hidden costs that might happen. While some are unavoidable, there are ways to reduce expenses or prevent them altogether by following a few simple tips:

Create an emergency fund.

To better prepare for and manage unforeseen costs, create an emergency fund. Many experts agree that having three months’ worth of your salary saved is the best back up plan to tap into if a pipe bursts or a rainstorm reveals a leaky roof.

Pay attention to product warranties.

A recent survey shows that 60 per cent of Canadians consider a company’s warranty program when making a purchase decision — and for good reason. A solid warranty program can save you money in the long term.

When researching appliances and electronics, look for those that have extended warranties and out-of-warranty programs. For example, LG offers a 10-year limited warranty on appliances, as well as an Out of Warranty program with a flat rate for labour and parts.

Don’t take shortcuts.

If a service or repair quote seems too good to be true, it likely is. It’s important to always look for a manufacturer-approved and authorized service provider to repair home appliances or electronics. If the service provider isn’t skilled in repairing your specific product, you run the risk of further damaging the item. Find more information at lgoutofwarranty.ca.

Stay tuned to My Thorold for updates on the local real estate market. We figure local conversations on Thorold home prices and related real estate issues will heighten as a hot topic trending in 2022.